The biologic drug market is huge in the US and it continues to grow at a rapid pace. However, great innovation come with greater costs. In the US, only 2% of prescriptions are written for biologic drugs, but the 2% accounted for 37% of total drug spend, which in 2018 was $125 billion in sales. Controlling drug costs and drug spend is a priority for all stakeholders in healthcare, especially in the biologic space. Biosimilars were supposed to create competition for their innovator counterparts to drive down biologic drug costs. Unfortunately, the emergence of biosimilars has not impact the biologic price enough, more work has to be done.

What are biosimilars?

Biosimilars are not generics because they are larger and more complex molecules compared to small molecule drugs like aspirin. Unlike generic versions of a brand name, small molecule drug, biosimilars are not exact copies of the reference biologic product, however they have the same clinical characteristics as their biologic innovator product. Biologics are produced from living organisms which require a complex manufacturing process that cannot be replicated. Biosimilars go through an abbreviated Biosimilar Biologic License Application under the 351(k) biosimilar pathway.

Slow start, but gaining momentum…

The passage of the Biologics Price Competition and Innovation Act (BPCI Act) in 2010 laid the groundwork for biosimilar approval by providing an abbreviated approval pathway for biosimilars. The approval of biosimilars was slow moving in the beginning as only 2 biosimilars (Zarxio and Inflectra) were approved prior to 2017. Since then, 28 biosimilars have been approved by the FDA. but only 17 of the 28 approved biosimilars were actually launched, and even when biosimilars are available, market penetration is often poor.

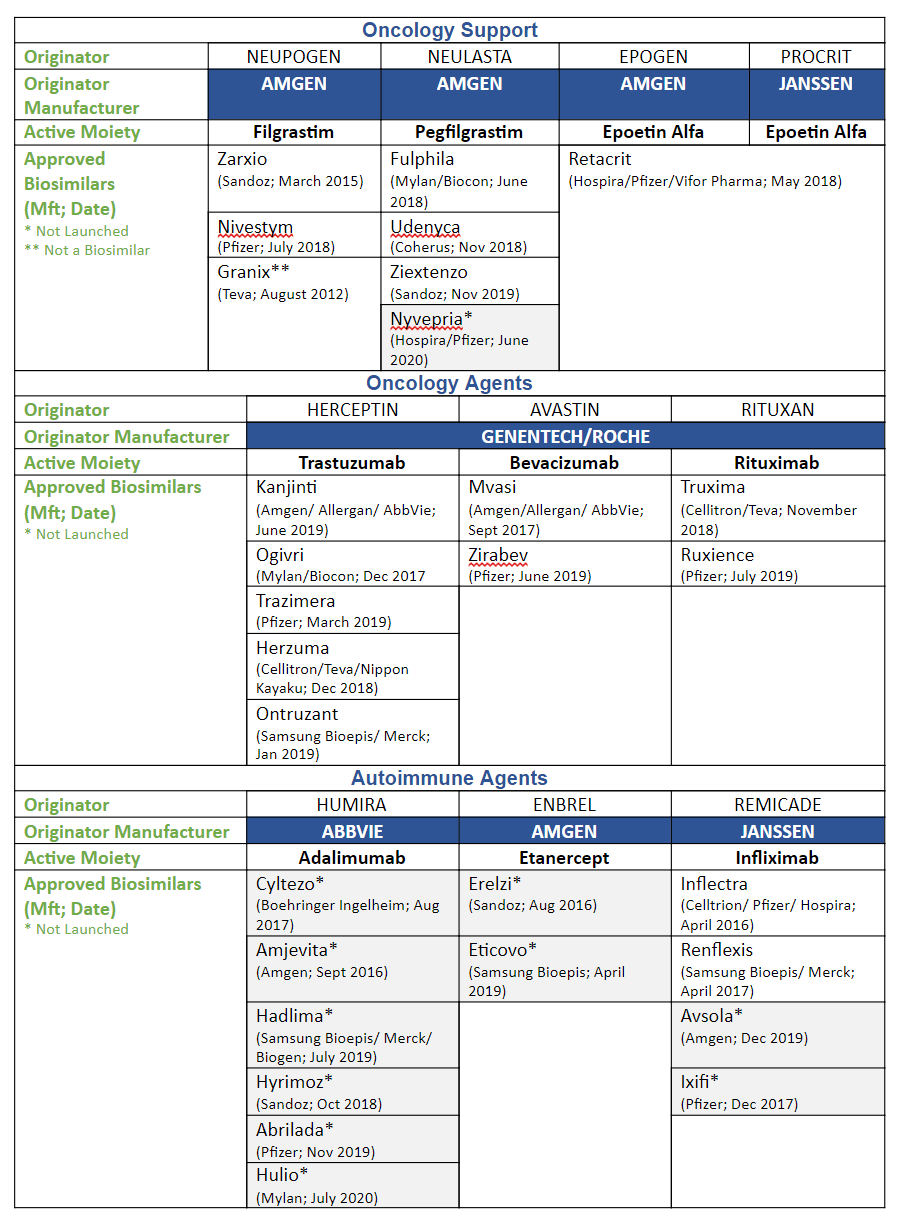

The following chart lists the approved biosimilars by drug class.

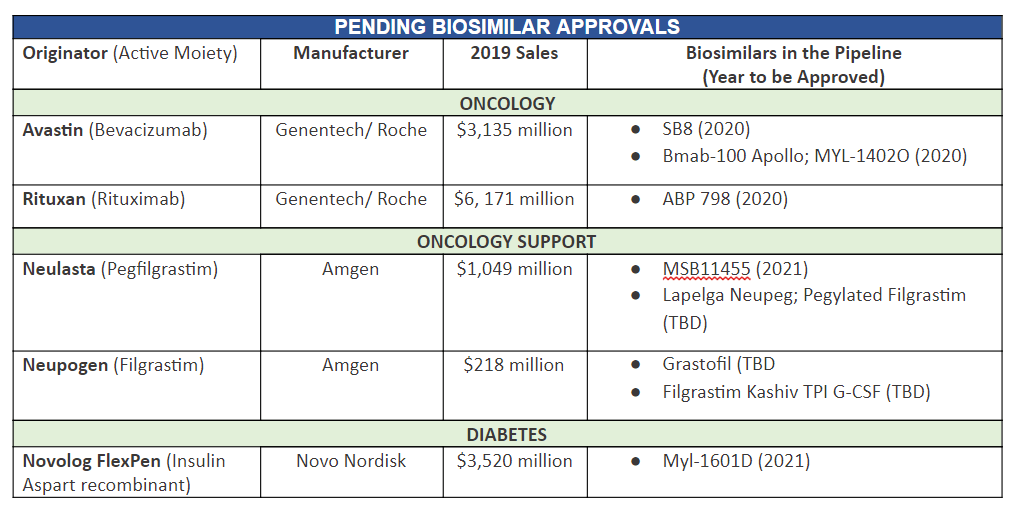

These are biosimilars in the pipeline that are expected to be approved in the near future.

Barriers to Biosimilar Adoption

In Europe, biosimilar adoption is much further along than we are in in the US. As of late 2018, 39 biosimilars had been launched in Europe; in some countries, biosimilars have completely captured a majority of the market share in various market segments. Several factors highlighted below have contributed to the biosimilar’s slow start in the US, but we’ve seen better uptake the past couple of years.

Interchangeability

One of the reasons why Europe adopted biosimilars more readily than the US is the concept of interchangeability. The European Union regulators do not have an interchangeability designation for biosimilars, they consider biosimilars substitutable to the innovator drug. The FDA has made it easier but not easy enough by publishing guidelines on how to achieve interchangeability in 2019. To date, no biosimilar has achieved interchangeability. The FDA needs to step up and approve interchangeability by indication when approving biosimilar agents otherwise adoption will remain limited.

Price

Originally, discounts were not great. Unlike generic drugs, which average less than 80% of the cost of the reference product, the difference between biosimilar and innovator product is much less, about 15% difference on average. Not only are biosimilars more complex to manufacture, the development costs of biosimilars are much higher than for generics. However, as more competitors have entered the biosimilar market, prices have been more competitive, and rebates are now being offered for biosimilars.

Patent Litigation

Since 2017, 28 biosimilars have been approved, but only 17 have actually launched. The primary reason for this revolves around patent litigations. Although the 2009 BPCI Act grants biologic drug manufacturers a 12-year market exclusivity period, patent litigation further delays competition. The patent system has long been gamed to prolong the reference drug’s exclusivity in order to delay launch of the biosimilar-pay to play tactics. Successful challenges to court rulings have started to open the doors for more biosimilar launches.

Formulary Status

A recent study showed US health plans selected biosimilars as the preferred drug just 14% (Infliximab is greater than 15%) of the time. One of the main reasons for this is the exclusionary contracting practices that the reference biologic companies use along with prescriber incentives on reimbursement for higher cost drugs (Average Sales Price plus reimbursement). When a biosimilar enters the market with a lower cost than the reference product, and the payor has a rebate contract with the originator manufacturer, the plan has to decide whether to keep the biosimilar off its formulary or pay the full list price for the reference product. However, in some cases like with the drug infliximab, the net cost of the innovator drug after rebate is still significantly higher than the biosimilar infliximab, but somehow payers do not switch to the biosimilar and continue to promote the innovator product at a higher cost. When the cost differential on the innovator drug after rebate and its biosimilar is not significant, the manufacturer of the reference drug leverages the payor into a decision by threatening to no longer offer rebates on the innovator drug and sometimes even its basket of drugs, if that biosimilar is allowed onto the formulary. This “rebate trap” significantly disincentivizes adding a biosimilar to the formulary. Facilities are incentivized by the innovator manufacturers to prescribe more costly drugs. If brand-name manufacturers can eliminate the financial viability of less-expensive biosimilars, no one will invest in biosimilars. There is a big concern that if payors don’t look at the big picture and just go for the short-term savings benefits, this will lead to reduced competition and unsustainable costs in the long run.

Conclusion

Currently, there are biosimilars approved for some of the biggest blockbuster innovator biologics out in the market today. Payors wanting to capture financial value from current biosimilar conversions and position themselves for even greater biosimilars savings in the future should get ahead of the curve and start developing a biosimilar strategy now.

Despite their slow take-off in the U.S. market, the time for biosimilars have arrived. We expect uptake to be quicker now and in the future. The medical community is becoming more educated, there are more clinical studies, the FDA has published guidance, pricing will become more favorable, and biosimilars are being added to formularies around the country.